kentucky lottery tax calculator

10252022Buy a Lottery ticket now. The amount of tax youll pay depends on your overall tax picture.

Are Lottery Winnings Taxed A Quick Guide Lottery Critic

5 Kentucky state tax on lottery winnings in the USA.

. These lottery tools are here to help you make better decisions. The tax rate is the same no matter what filing status you use. Additional tax withheld dependent on the state.

Calculate your lottery lump sum or. Updated january 06 2018 085749theres no need to panicthere are no new. For one thing you can use our odds calculator to find the lotteries with the best chances of winning.

Heres how much taxes you will owe if you win the current Powerball jackpot. That decision paid off in a big way as he won over 234000 on an Instant Play game. Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the.

Other Lottery Calculators and Tools. This breakdown will include how much income tax you are paying state taxes. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot.

In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. I was bored and it gave me something. That means that on a 20 million ticket youd pay 5 million to the.

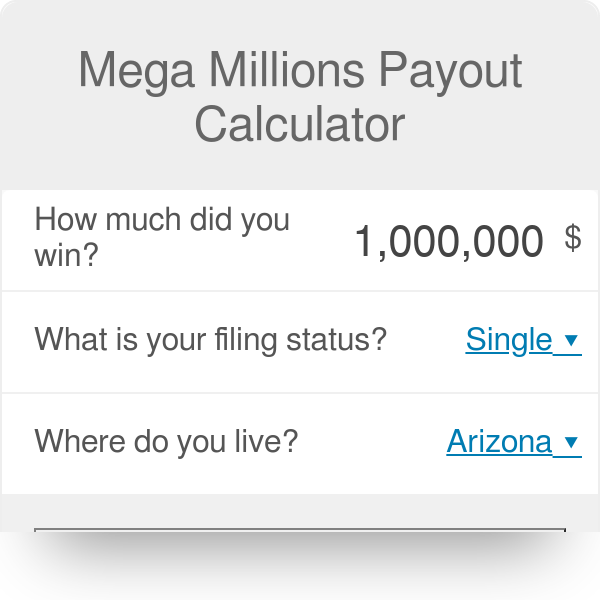

Our Mega Millions calculator takes into account the federal and state tax rates and calculates payouts for both lump-sum cash and annual payment options so you can compare the two. Using the lottery annuity payout calculator you can see the estimated value of the different payout installments for each year. Capital gains are taxed as regular income in Kentucky.

The state has the choice to impose additional taxes for example if you win the lottery in New York you pay an additional. Lucky For Life KY. Probably much less than you think.

This is still below the national average. Aside from state and federal taxes many Kentucky. Kentucky lottery tax calculator.

Texas has chosen to add 0 additional taxes to lottery winnings. To fill the time he began playing Kentucky Lottery games online. The tax rate is the same no matter what filing status you use.

Lottery tax calculator takes 6. Kentucky imposes a flat income tax of 5. 25 State Tax.

Overview of Kentucky Taxes. 25 State Tax. This can range from 24 to 37 of your winnings.

Lottery tax calculator takes 6. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. 5 Louisiana state tax on lottery winnings in the USA.

You can find out tax payments for both annuity and cash lump sum. This tool helps you calculate the exact amount. Kentucky pales in comparison to the federal lottery tax rate which is an astounding 25 percent on all winnings over 5000.

This varies across states and can range from 0 to more than 8.

Prize And Odds Chart Lottostrategies Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Mega Millions Payout Calculator After Tax July 26 Heavy Com

Vaccine Lottery Taxes On Lottery Winnings Tax Foundation

What Percentage Of Lottery Winnings Would Be Withheld In Your State

Mega Millions Payout Calculator

Lottery Tax Calculator Updated 2022 Lottery N Go

Lottery Tax Calculator Updated 2022 Lottery N Go

Best Lottery Tax Calculator Updated 2022 Mega Millions Powerball Lotto Tax

Lottery Tax Calculator Updated 2022 Lottery N Go

What Is The Tax On Lotto Winnings In California Sapling

Pick 4 Kentucky Ky Latest Lottery Results Game Details

Lottery Calculator The Turbotax Blog

Lottery Calculator The Turbotax Blog

Taxes On Lottery Winnings In Kentucky Sapling

/images/2022/02/04/woman_with_lottery_ticket.jpg)

5 Tips For Avoiding Taxes On Lottery Winnings Financebuzz

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Best Lottery Tax Calculator Updated 2022 Mega Millions Powerball Lotto Tax

Lottery Tax Calculator What Percent Of Taxes Do You Pay If You Win The Lottery By Charles Weko Medium