how to calculate net debt from cash flow

Press the CF Cash Flow button to start the Cash Flow register. Then the Cash and Cash Equivalent at.

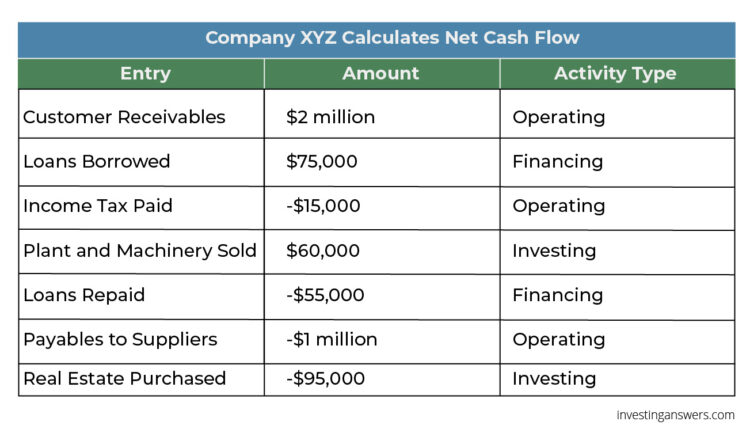

Net Cash Flow Formula Definition Investinganswers

Conceptually similar to unlevered free cash flows CFADS is calculated as follows.

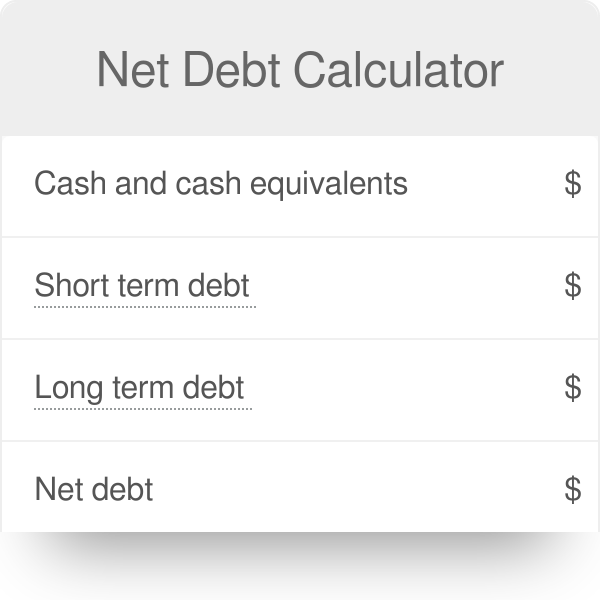

. Retained Cash Flow - RCP. Retained cash flow RCP is a measure of the net change in cash and cash equivalent assets at the end of a financial period. Cash Cash Equivalents 30m Cash 20m.

Hit the down arrow to. It is the difference. There are two different methods that can be used to calculate cash flow.

NCF 50000 - 70000 15000. You might have a car payment left-over student loans a credit card or two a veritable rainbow of borrowed. 400000 operating cash flows 2000000 total debt 20.

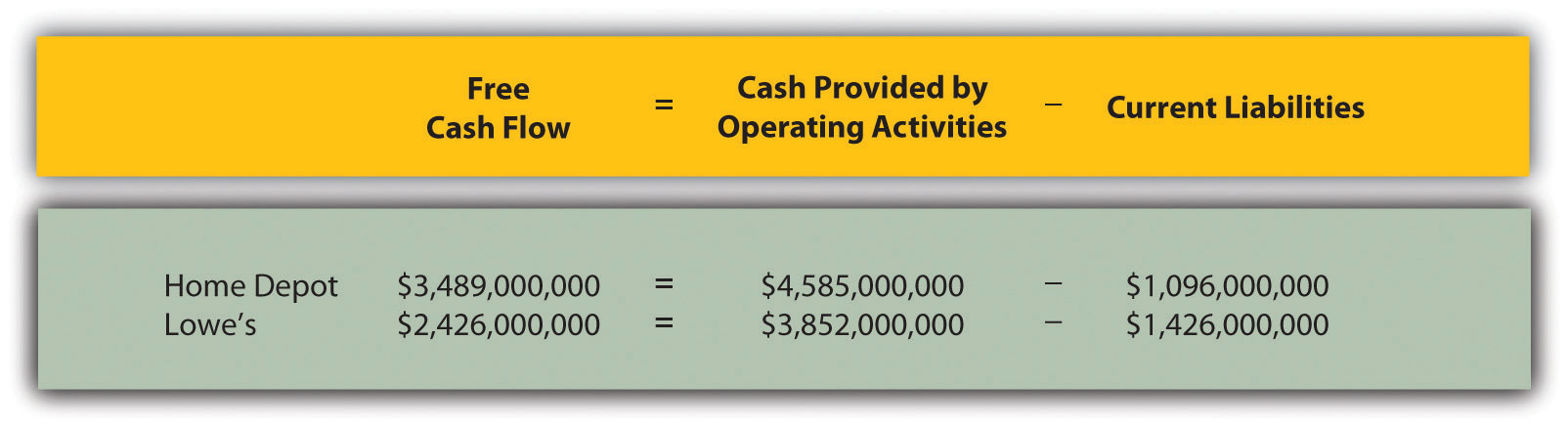

For Year 1 the calculation steps are as follows. Most people have a fairly varied debt portfolio. Free cash flow net cash flow.

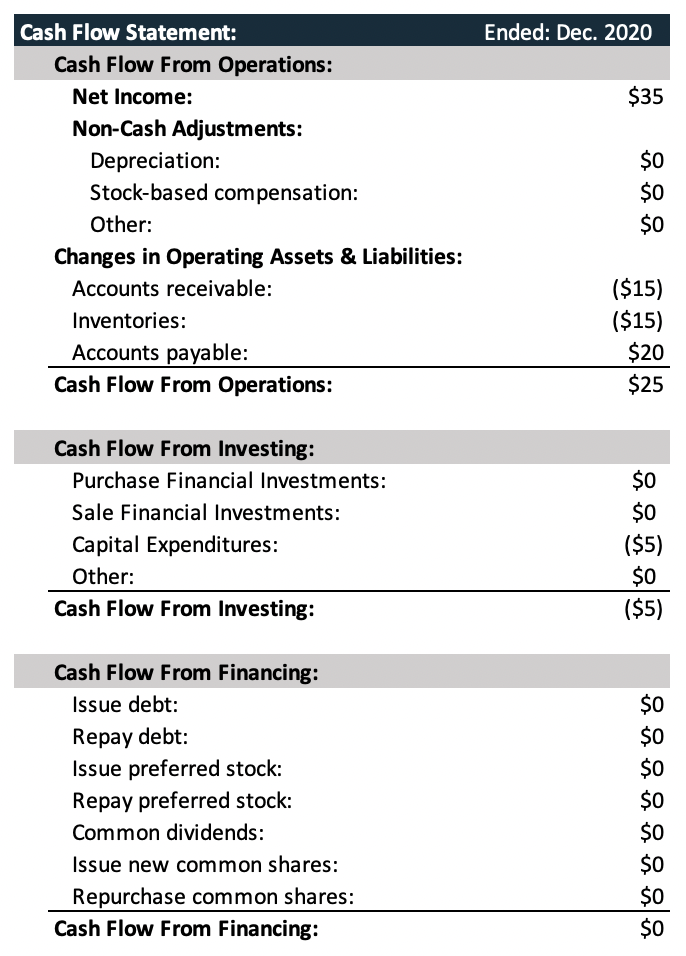

Debt Free Cash Flow example. Its operating cash flow for the past year was 400000. This is a measure of the amount of money generated or spent as part of normal business operations.

Calculating the ratio reveals that its levered. The direct method lists and adds all of the cash transactions including payroll. Enter the initial investment negative number.

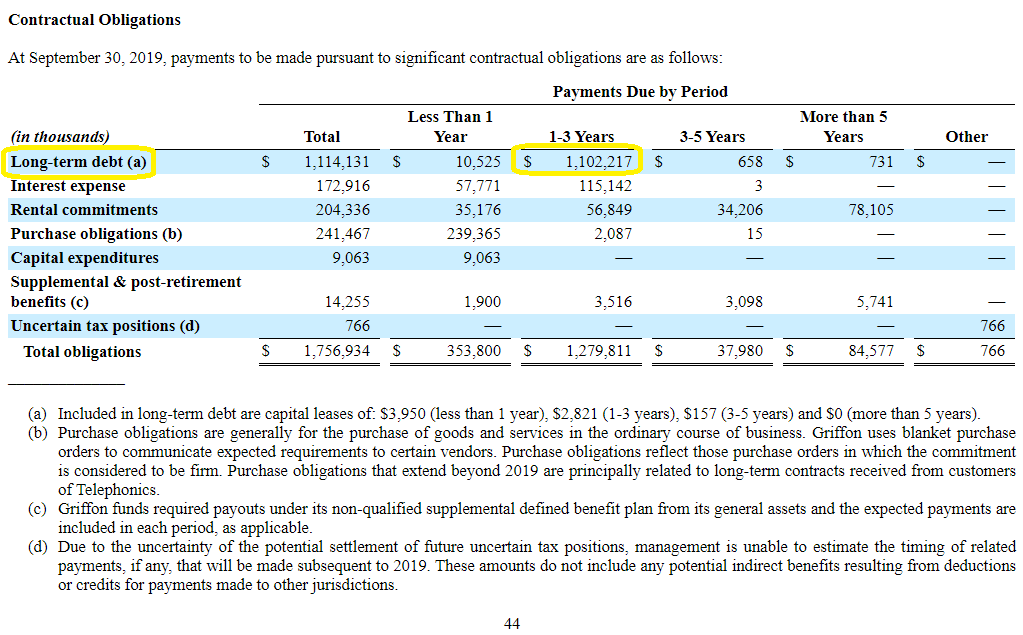

Cash Flow Available for Debt Service CFADS Revenue Expenses - Net Working Capital Adjustments. Heres the formula for calculating cash flow from financing activities. Cash flow from financing activities net debt net equity net capital leases - dividend payments.

Lets assume that the Net Increase in Cash and Cash Equivalent is 360000 and the Cash Equivalent at the beginning of the period is 140000. Net borrowing can be calculated by subtracting the amount of debt repaid in the year from the total debt borrowed during the year. To calculate cash flows of this type you need.

To calculate NCF for the month hed do the following calculation. Free cash flow is. Using a financial calculator enter the following.

The NCF for the specific period would be a negative cash flow of 5000. Cash flows mean the inflows and the. Total Debt 40m Short-Term Borrowings 60m Long-Term Debt 100m.

The free cash flow indicates to the company how the Cash and cash equivalents at the end of a financial period is ordered. Therefore its cash flow to debt ratio is calculated as. For example lets assume Company A has 10 million levered cash flow and its market capitalization value of equity is 200 million.

Free Cash Flow Explanation Definition Calculation Speck Company

What Is Net Cash Flow Formula How To Calculate It

Analyzing Cash Flow Information

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

How To Calculate Cash Flow 15 Steps With Pictures Wikihow

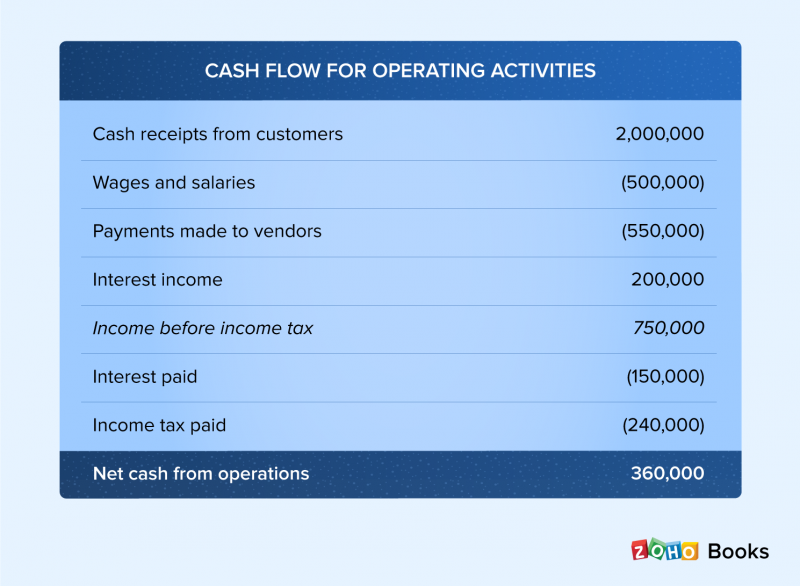

How To Calculate Cash Flow For Your Business Direct Vs Indirect Cash Flow Zoho Books

Free Cash Flow Calculator Free Cash Flow

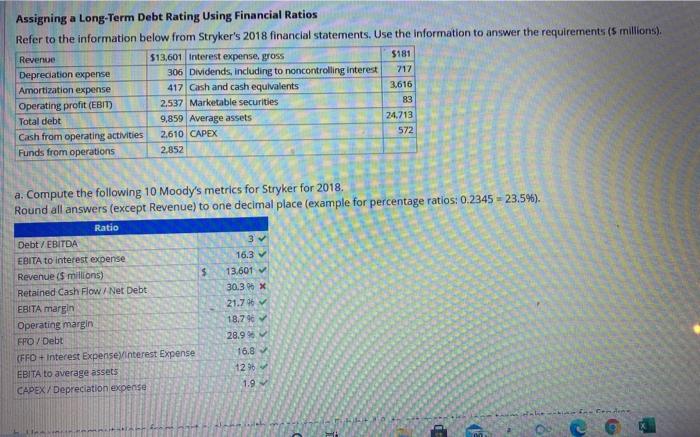

Solved What Is The Retained Cash Flow Net Debt Ratio Amp Chegg Com

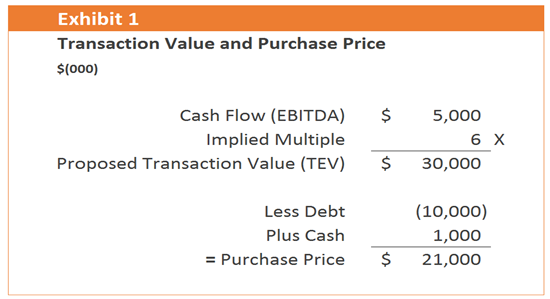

M A Essentials Understanding Purchase Price Cohen Company

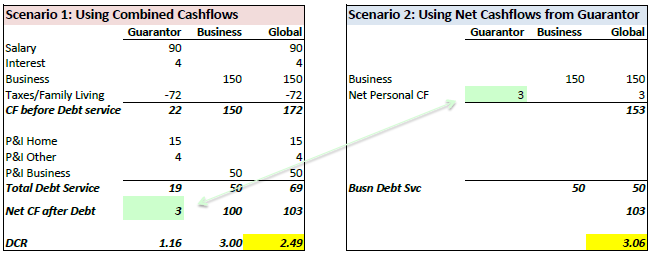

Linda Keith Cpa How To Calculate Global Dcr

Discounted Cash Flow Analysis Street Of Walls

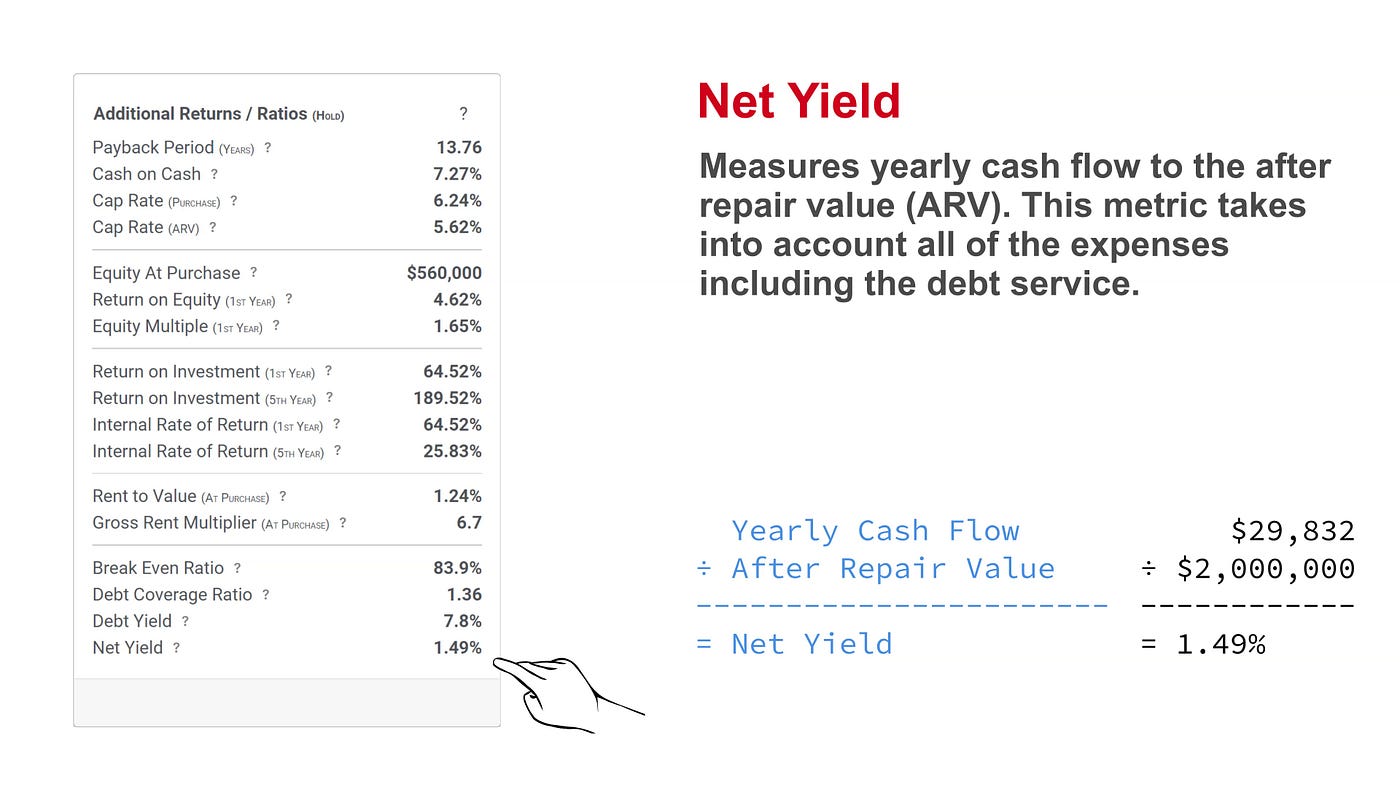

Property Flip Or Hold How To Calculate Net Yield Marco Napoli Medium

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Financial Ratio Notes What Is The Operating Cash Flow Ratio The Operating Cash Flow Ratio Is A Studocu

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

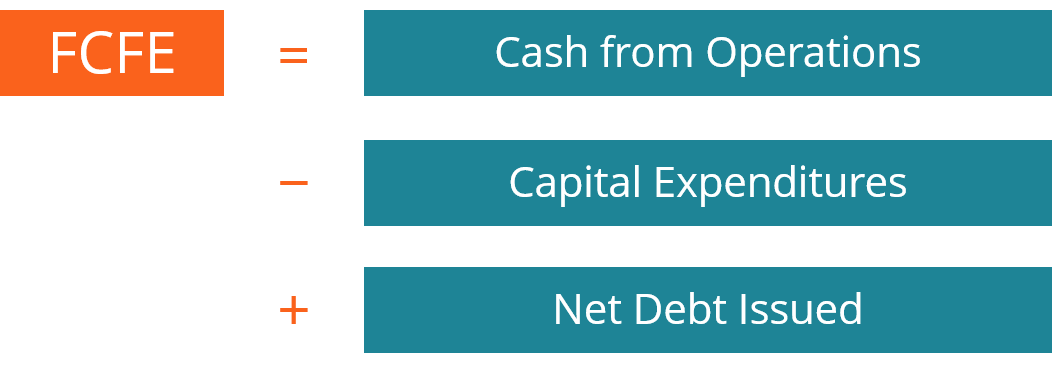

Free Cash Flow To Equity Fcfe Learn How To Calculate Fcfe

How To Calculate Net Change In Cash From A Cash Flow Statement The Motley Fool